OK, Everybody; Let’s Play: Find The Bank!

Situation 1: People need to borrow money. They put up collateral against the sum they need, after a gimlet-eyed appraisal by the lender. The borrower pays a non-adjustable rate of interest on the money. There is usually a balloon payment due at the end of the term to repatriate the collateral. If the borrower defaults, the lender keeps the collateral and sells it to others more able to afford it.

The deals are essentially made between the two parties with a handshake. The lender uses his expertise, hard-won in the marketplace, and subject to the immediate loss of capital should he mis-appraise more than a handful of items in a hundred. If the lender dips into the funds he keeps on hand that allow him to supply the liquidity his customers demand, to squander on his own amusement or speculations, or if he tries to capture business that he is not prepared to handle for a short-term bump in his notoriety, or to monkey around with the short-term look of his balance sheet, he will immediately go out of business. Since his business is predicated on good relations with his customers and his neighbors in his local community, the lender strives to keep on genial terms with the public.

The lender relies on other experts from time to time, but generally relies on his own good sense. The borrower is in an equal, or superior, position to the lender in determining the value of the property he uses for collateral, as he is in possession of it already and knows its provenance. In any case, the terms of the loan are entirely straightforward and immutable and agreed upon by both parties with no proxies. The lender does not employ any strong-arm tactics to make the loan, and certainly does not need any when the borrower is in default. He simply takes over possession of the asset in a perfectly straightforward and legal process and sells the asset if he can.

Situation 2: People need to borrow money, so they put up capriciously appraised collateral, sometimes that they don’t even fully own, and/or submit to a byzantine, arbitrary, personal appraisal of their financial affairs made by a slew of shady and disreputable third parties. Both the lender and the borrower know that the third party appraisals are akin to a farce, but neither really cares about the long-term viability of their transactions. The borrower generally has no intention of following through on the terms of the loan all the way to its end, and will try to foist his obligations or the original collateral off on another party in the interim. The lender likewise has no intention or expectation of the loan being paid off on the terms on which it was made, and may secretly desire the borrower to default on the deliberately convoluted and intricate terms so that the borrower’s obligations can be increased. Sometimes the lenders repatriate collateral from defaulted loans that they don’t even really want, by force, and then just destroy it to appease some kind of lust for destruction or as a warning to others, or more generally as part of a Minotaur-worthy tax evasion scheme.

The lender generally slips the loan into a weird, giant package of other loans, which is then sold to other, unwitting lenders under the guise of a business opportunity. These lenders who would be left with little or no recourse if (and more generally, when) the borrower defaults on his loan.

Other types of loans are made without collateral by these same lenders. They employ a capricious and sometimes draconian sliding scale of interest rates, penalties and fees, deliberately obscured from the borrower to entice them to borrow money at one rate while allowing the lender to collect the loans at a much higher, often usurious rate. If the borrower doesn’t pay, the lender begins a non-stop campaign of threats and harassment against the borrower, often hiring vicious and unscrupulous third parties to collect the debts for them, regularly using a campaign of terror that involves the destruction of the borrower’s reputation in his home, neighborhood, place of business and among a multitude of government agencies, where many unscrupulous bureaucrats are willing participants in the swindle, and often receive payments from both parties in the disputes.

The lenders are not well educated or experienced in the forces of the marketplace, and simply join breeder gangs of like-minded persons, many with bizarre initiation rituals among members of a self-selecting and homogenous elite. They are bullheaded, extravagant, and greedy, often dipping into their funds to speculate wildly in all sorts of shady enterprises, mostly using inside information, and regularly secretly betting against their public positions in the market and against their own customers. They are not afraid of a loss of capital because they are adept at skimming money from insurance scams, looting retirement funds, tax evasion, and other government swindles, counterfeiting, and when all else fails, they terrorize entire communities with the threat of taking everyone with them when they go down.

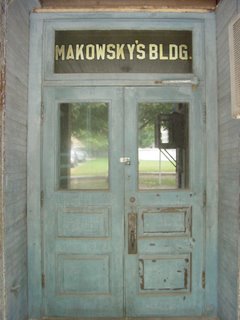

OK, take a crack at it in the comments. Which is the bank, and which is the pawn shop? But remember, no wagering! I’m not running a casino here, which is like the stock market, but with fewer gangsters.

[Note: This post was edited and updated, but legacy comments were preserved]

Recent Comments